The OnlyBoth/Benchmine engines will now include 401(k) plans whose plan year begins in Q2, Q3, and Q4. We will start with the plans in the $1B+ assets bracket, and update all the seven assets brackets in the coming days.

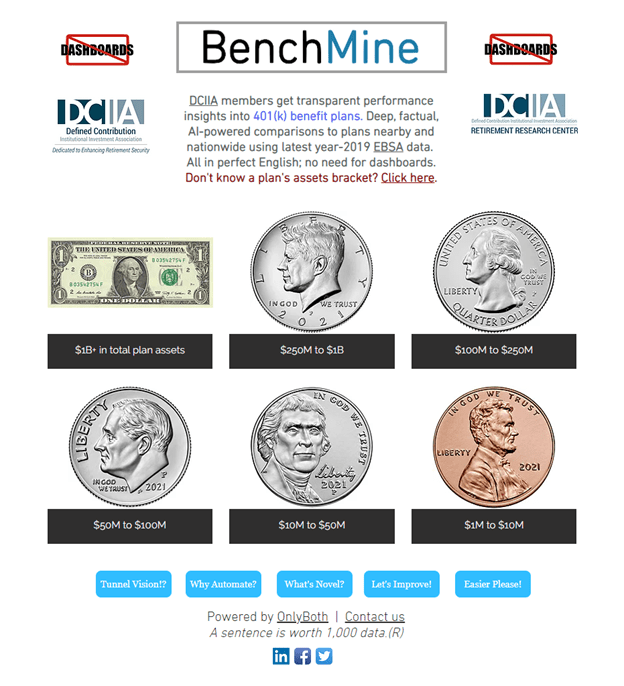

When first applying to 401(k) plans the OnlyBoth AI-powered technology for comparative performance analytics & reporting, we opted to limit the scope of the BenchMine tools to plans whose plan year began in Q1 (Jan-Mar), which covered about 95% of them. Our reasoning was that a one-year comparison of plans starting in Q1 to plans starting, say, in Q3 would not be a fair comparison, because highly external factors such as the stock market could lead to, say, an inferior performance during that calendar year but a superior performance during the next (or previous) year. Enlarging the comparison to multiple years could make it less unfair but would obscure the yearly plan performance.

This author appeared on a panel on Benchmarking Investments and Fees at the 2025 PLANSPONSOR National Conference in Chicago. In the audience was a plan advisor who, after the panel ended, came to offer compliments on the free and open tools available at BenchMine.com. During a subsequent conversation, the advisor asked about a plan that was not in the BenchMine data, and I checked and answered that its plan year began in Q2. After further discussion, I began to wonder: “Can such plans be included while making adjustments to minimize the unfair comparisons?”. After some deliberation, the answer turned out to be “Yes”.

Here are the key steps to the inclusion approach.

- First, add the symbolic attribute “plan year began in”, with possible values Q1, Q2, Q3, or Q4 to every plan. This will enable doing simple searches at the Discovery Engine such as “List the Q2 plans by highest total administrative expenses.”

- However, prevent this new attribute from being used within benchmarking insights, e.g., “This plan had the highest total administrative expenses of all the Q2 plans in the Manufacturing sector.” which seems less insightful or interesting than other peer comparisons.

- Identify those plan measures that are most sensitive to external factors. We selected the measures that involve earnings, income, and yield.

- For Q2, Q3, and Q4 plans, replace those sensitive measure values with N/A, to avoid comparisons to other plans with a different Q (quarter). However, let users easily see the values in the plan’s profile, which will state something like “net income ($X, but changed to n/a because the value of ‘plan year began in’ must equal ‘Q1’).”

Note that for plan years that begin in Q2, Q3, or Q4, performance measures relating to earnings, income, and yield will not be used for comparison in the Benchmarking Engine. This means that the Scoring Engine results for such plans will be less comprehensive, since the benchmarking scores for such plans will rely on administrative and operational aspects such as expenses, contributions, asset diversity, balances, liabilities, corrective distributions, insurance coverage, and possible fraud.

We believe that the above approach will bring added value to the benchmarking of 401(k) plans, while minimizing the introduction of unfair or misleading comparisons.

Raul Valdes-Perez